Since its establishment in 2018, Anova Capitals has operated in the market as a Contract for Difference (CFD) broker. The company primarily utilizes widely-used trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader to offer its users a range of trading products, including forex, cryptocurrencies, and other CFDs. However, the legitimacy and regulatory compliance of this broker have become a major concern for many investors. This article will explore Anova Capitals’ registration information, regulatory status, and real-life case studies to help investors make more informed decisions.

1. Background and Business Scope of Anova Capitals

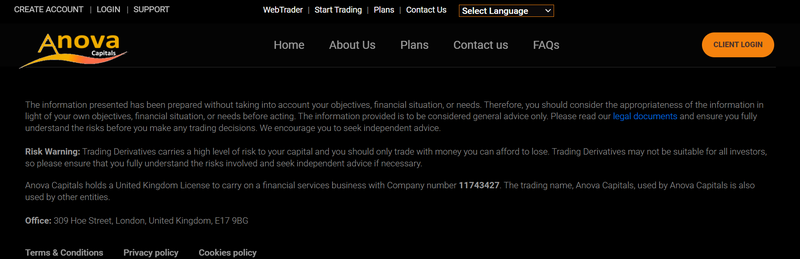

Anova Capitals is registered in the UK under the company name ANOVA INVESTMENTS LTD, with the registration number 11743427. The company claims to possess a license to conduct financial services in the UK and offers a variety of financial products across multiple trading platforms, including:

- Cryptocurrencies: Provides trading in mainstream cryptocurrencies such as Bitcoin, Ethereum, and Ripple.

- Forex Trading: Forex is one of Anova Capitals’ core businesses, offering major currency pairs like EUR/USD and GBP/USD.

- Contracts for Difference (CFDs): Covers a variety of assets including stocks, indices, and commodities, catering to different types of investors.

This business model attracts many traders seeking diversified investments. However, the uncertainty in financial markets and the mixed nature of brokers also pose certain risks to investors.

2. Registration Information and Regulatory Status of Anova Capitals

1. Authenticity of Registration Information

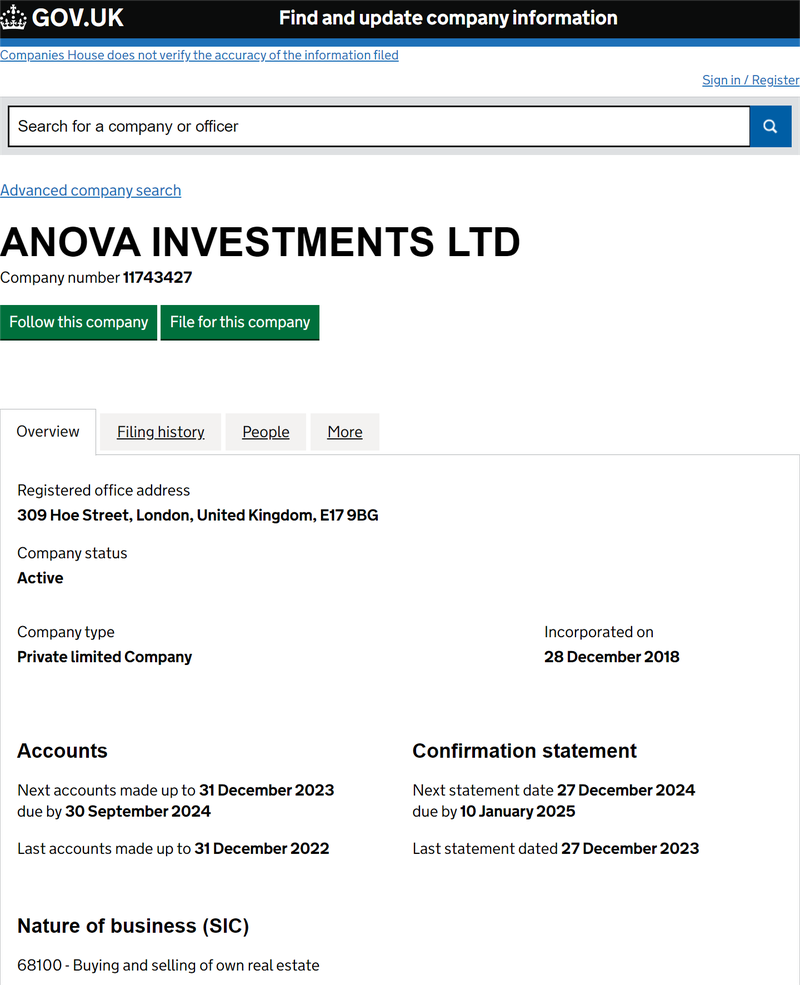

The UK Companies House website lists Anova Capitals as ANOVA INVESTMENTS LTD with registration number 11743427, confirming its existence as a legal entity in the UK. However, registering a company in the UK is relatively simple and does not guarantee strict regulation in the financial sector.

2. Questionable Regulatory Status

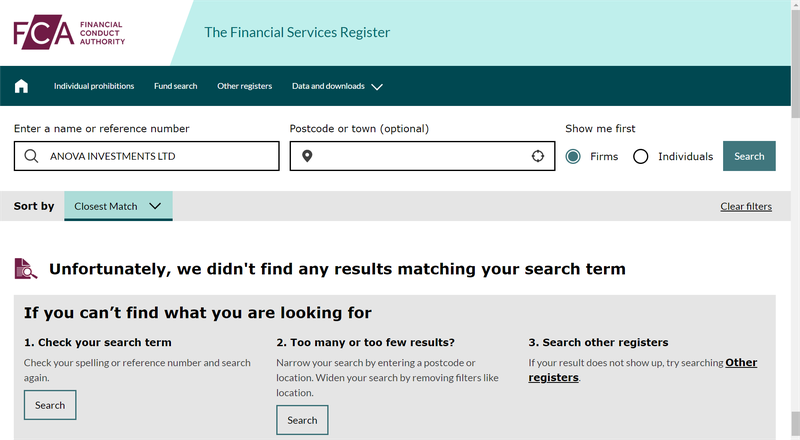

Anova Capitals claims to hold a financial services license issued by the UK’s Financial Conduct Authority (FCA). However, upon verification on the FCA’s official website, there is no record of ANOVA INVESTMENTS LTD or its registration number 11743427. This indicates that Anova Capitals may not be FCA-regulated or has not obtained a legitimate license to operate financial services in the UK.

In the UK, licensed financial institutions are subject to strict regulation by the FCA, including requirements for customer fund security, risk disclosure, anti-money laundering laws, and more. Unregulated companies often cannot ensure fund safety and transparency, posing a significant risk to investors.

3. Potential Risks of Operating Without Regulation

Lack of regulation or being unregulated is a primary concern for many investors. The FCA is the main regulatory body in the UK, responsible for oversight, monitoring, and enforcement in the financial markets. If a company is not regulated by the FCA, it implies:

- Insecure Investor Funds: Regulated brokers must separate client funds from the company’s own, storing them in different bank accounts to reduce the risk of client fund loss in case of company bankruptcy. Unregulated companies are not bound by this requirement, and investor funds might be at risk of misuse.

- Doubtful Trading Fairness: FCA-regulated companies must follow a series of trading and pricing standards to ensure fairness and transparency in transactions. Unregulated brokers may manipulate prices, cause excessive slippage, or deny clients withdrawals.

- No Recourse for Complaints: If a dispute arises with an FCA-regulated company, investors can file complaints to the FCA and seek arbitration. With unregulated companies, investors often have no reliable channel for complaints.

4. Real Case Studies: Risks of Unregulated Brokers

To better understand the risks of an unregulated status, we can refer to some cases involving other similar companies.

Case 1: An Unregulated CFD Broker Absconding with Funds

In recent years, many CFD brokers have attracted investors by exploiting their unregulated status. In 2019, an unknown CFD broker gained the trust of many investors by promising high returns. Initially, the company offered favorable trading conditions, attracting clients to continually add funds. However, a few months later, the company website shut down, clients could not withdraw their funds, and the losses were immense. Since the company was not regulated, investors ultimately had to bear the losses on their own, with no official channels to recover their funds.

Case 2: Fund Misappropriation and Price Manipulation

An unregulated forex broker manipulated prices on its trading platform, causing clients to incur losses even during normal market conditions. Worse, after clients deposited funds, the company transferred the funds directly to its own account for other uses, ultimately leaving investors empty-handed. Such situations could occur with any unregulated financial service provider, including Anova Capitals.

5. Why Is Regulation Important?

For investors in CFD, forex, and cryptocurrency markets, choosing a regulated broker is crucial. Regulation not only serves as a constraint on the company’s operations but also as a protection for investors’ interests. The main functions of regulatory agencies include:

- Fund Security: Requires companies to segregate client funds from operational funds, ensuring the independence of client funds.

- Anti-Money Laundering Measures: Enforces strict KYC (Know Your Customer) and AML (Anti-Money Laundering) policies to prevent illegal activities.

- Market Fairness: Standardizes trading rules to prevent price manipulation, misleading clients, and other misconduct.

- Dispute Resolution: Provides clients with complaint channels to arbitrate disputes.

6. How to Verify the Legitimacy of a Broker?

- Check Registration Information: Visit the website of the country’s Companies House or relevant department where the broker is based to verify its registration information. For example, UK investors can look up corporate registration details through Companies House.

- Verify Regulatory Status: Search for the broker’s regulatory status on the official website of the claimed regulatory body. For instance, enter the company’s name or registration number on the FCA’s website to find relevant information.

- Review Customer Feedback: Look up experiences and reviews from other investors on financial forums, social media, and professional websites. While these do not completely represent the facts, they can reveal the company’s operational behavior.

- Test Customer Service: Legitimate brokers typically offer timely and professional customer service. You can test their responsiveness and service quality through a trial account or by contacting customer support.

7. Is Anova Capitals Trustworthy?

Given the currently available public information, while Anova Capitals is indeed registered in the UK, its claimed FCA regulatory status cannot be verified. This casts doubt on its legitimacy and credibility as a financial service provider. Investors should remain vigilant and prefer regulated brokers with a solid reputation to minimize potential risks.

8. Frequently Asked Questions (FAQ)

1. Is Anova Capitals regulated by the FCA?

Based on existing information, there is no record of Anova Capitals’ regulatory status on the FCA website. Although the company claims to hold a license, investors should carefully verify this information.

2. How can investors confirm a broker’s regulatory status?

You can verify a broker’s regulatory status on the official website of the regulatory body it claims to be regulated by, using the broker’s registration number and company name.

3. What risks do unregulated brokers pose?

Unregulated brokers may misuse client funds, manipulate prices, engage in unfair trading practices, or refuse client withdrawals.

4. What are Anova Capitals’ main business offerings?

Anova Capitals primarily offers trading services for cryptocurrencies, forex, and CFDs on platforms like MT4, MT5, and cTrader.

5. How to identify a legitimate broker?

Legitimate brokers are usually regulated by authoritative bodies and provide detailed company information, regulatory numbers, and related documents on their official website.

6. What should investors consider when choosing a broker?

Investors should review the broker’s regulatory status, customer reviews, trading fees, platform stability, and the quality of customer service.