Bridge Markets claims to be a global brokerage firm offering a wide range of trading services, yet its offshore registration and lack of regulatory oversight raise serious concerns for investors.

Company Background

1.1 Company Overview

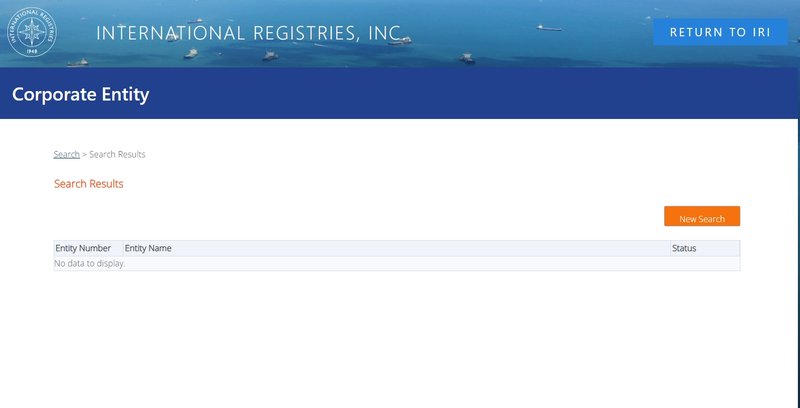

Bridge Markets, reportedly headquartered in the Marshall Islands, operates under the entity Bridge Markets Ltd. The company claims to offer a variety of financial products, including forex, metals, stocks, and cryptocurrency CFDs. According to their website, they are registered with number 113891, aiming to assure investors of their legitimacy. However, further investigation reveals no matching record for this company name or number in the Marshall Islands registry. This lack of verifiable registration raises doubts about Bridge Markets’ authenticity as a legitimate financial entity.

1.2 Risks of Offshore Registration

The Marshall Islands is a well-known offshore financial center, popular for companies looking to avoid strict regulatory standards. However, the Marshall Islands does not regulate forex or CFD trading, leaving financial platforms registered there largely unregulated. With this setup, investors are often left unprotected and unable to seek legal recourse if the platform encounters issues. Despite Bridge Markets’ claims of legality, the lack of effective regulatory oversight presents substantial risks to investors.

Registration Information

2.1 Verifying Registration Claims

Bridge Markets claims to hold registration number 113891 in the Marshall Islands, but no matching record was found in the island nation’s corporate registry. Even if it does exist, the lack of oversight over financial entities in the Marshall Islands leaves significant uncertainty about the company’s compliance. This ambiguity in registration often leads investors to question the transparency and legitimacy of such platforms.

2.2 Risks of Operating Without Regulatory Oversight

Since the Marshall Islands does not regulate financial derivatives, companies registered there often lack stringent financial oversight. In contrast, firms regulated by reputable authorities like the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) are held to strict standards on fund management, financial transparency, and regular audits, which help protect investors. Bridge Markets, however, lacks any financial regulatory oversight, leaving investors vulnerable to higher risks.

Risks of an Unregulated Platform

3.1 Inherent Risks of an Unregulated Platform

Bridge Markets claims to be “regulated” by the Marshall Islands, yet the nation does not oversee forex or CFD trading, creating a regulatory gap that could allow for mismanagement of funds. Unregulated platforms often lack transparency, creating potential for hidden fees, misuse of client funds, or unfair trading practices. If any disputes or financial issues arise, investors would have limited legal recourse.

3.2 Historical Risks of Unregulated Platforms

Unregulated offshore platforms in the finance industry have a history of significant risks. Offshore sites with loose regulatory oversight have been known to engage in fraudulent activities, such as fund misappropriation. Some unregulated platforms attract deposits only to restrict withdrawals or close accounts, causing serious financial losses for investors. Choosing a regulated trading platform is essential for safeguarding funds and maintaining transparency.

High Leverage Risks

4.1 The Appeal and Risks of High Leverage

Bridge Markets offers leverage of up to 1:500, a level that, while potentially attractive, greatly increases the risks associated with trading. High leverage can amplify returns, but it can also result in significant losses, especially in volatile markets. In cases of sudden market shifts, high leverage can quickly lead to a complete loss of account funds, or “liquidation.” For new traders or those with limited risk management skills, this can result in severe financial consequences.

4.2 Regulatory Limits on Leverage

In contrast, regulated financial institutions generally impose strict leverage caps. For example, the European Securities and Markets Authority (ESMA) sets leverage limits at 1:30 for retail traders to protect investors from significant losses. Bridge Markets’ high leverage, although appealing to some traders, brings excessive risk, and investors should carefully assess this factor.

Concerns with Spreads and Commissions

5.1 Unstable Spreads

Bridge Markets advertises competitive spreads starting from 0.0 pips. However, during periods of high market volatility, spreads may fluctuate significantly. This instability could lead to additional costs for traders who are sensitive to transaction expenses. Unstable spreads can reduce profitability, especially in volatile markets where spread widening can increase transaction costs.

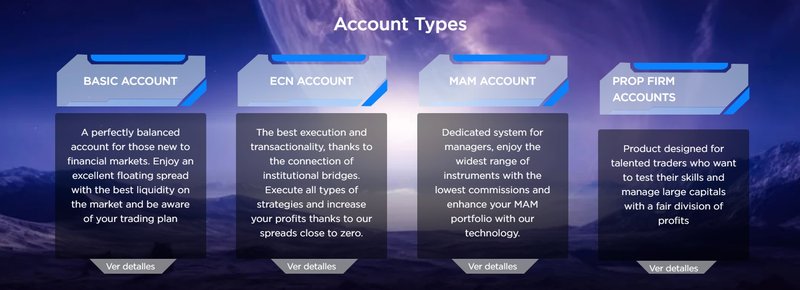

5.2 Hidden Commission Costs

While Bridge Markets’ Basic and MAM accounts are commission-free, which seems cost-effective, the trade-off could be slower execution or reduced service quality. For ECN accounts, each trade is charged a $6 commission per lot, which can add up significantly for frequent traders. Investors should thoroughly understand the cost structure of commissions and spreads when choosing a platform to ensure compatibility with their trading strategies and cost-management goals.

Conclusion

An in-depth analysis of Bridge Markets’ background, domain information, registration, lack of regulation, leverage, and spreads reveals substantial risks. First, Bridge Markets is registered offshore in the Marshall Islands without financial regulatory oversight, limiting protection for investors. The platform’s lack of transparency, especially in cost structure, leverage, and spreads, further complicates risk assessment. For investors seeking fund security, choosing a regulated platform with a transparent structure is essential.

Bridge Markets’ current conditions indicate higher investment risks and insufficient regulatory protection. Investors should thoroughly consider these factors and evaluate the platform carefully to avoid potential financial losses arising from its inherent risks.

Frequently Asked Questions (FAQ)

1. Is Bridge Markets regulated?

Bridge Markets claims to be registered in the Marshall Islands but lacks any real regulatory oversight.

2. When was Bridge Markets’ domain registered?

The platform’s domain was registered on July 8, 2022, making it relatively new without long-term market validation.

3. What products does Bridge Markets offer?

Bridge Markets offers CFD trading on forex, precious metals, stocks, and cryptocurrency indices.

4. What is Bridge Markets’ maximum leverage?

The platform provides leverage of up to 1:500, which is significantly higher than many regulated platforms and presents high risks.

5. What are Bridge Markets’ spreads and commission fees?

Spreads start from 0.0 pips but may be unstable, while ECN accounts charge a commission of $6 per lot, which can become costly for frequent trading.

6. How can I assess if a platform is secure?

Investors should prioritize platforms regulated by reputable authorities (like FCA or CySEC) to ensure fund security and transparent fee structures.