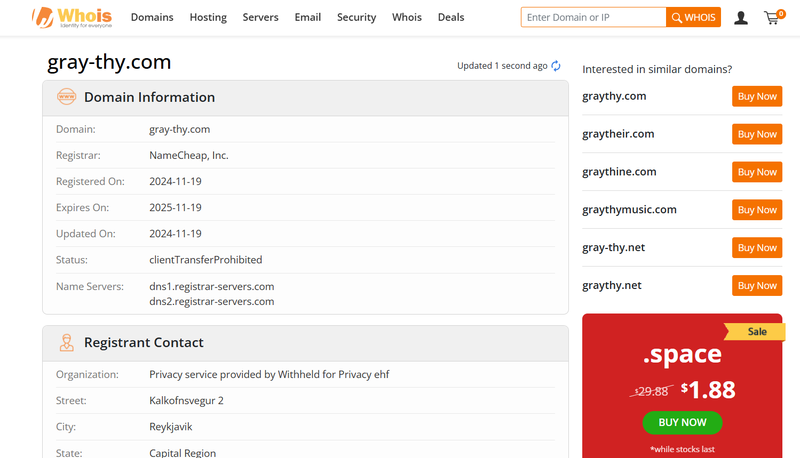

Gray-Thy is a newly established forex and financial trading platform, launched on November 19, 2024, with its official domain at gray-thy.com. The company says it provides many financial services. These include forex, precious metals, and energy trading. However, there are big concerns about its regulation, transparency, and user experience. Investigations reveal potential fraud risks, making this platform highly questionable. This article gives a detailed look at Gray-Thy’s features and possible risks. It aims to help investors make smart choices.

1. Overview of Gray-Thy: Background and Controversies

1.1 Platform Background

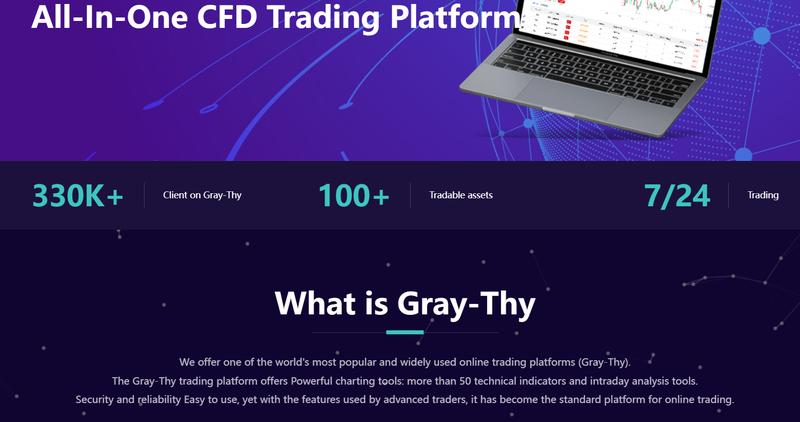

Gray-Thy was founded on November 19, 2024. It provides online trading for forex, precious metals, and energy. Its website says it has global coverage and offers advanced tools and services. As a new platform, it has major issues with user reviews, market recognition, and transparency. This is especially true for investors who worry about the safety of their funds.

1.2 Market Presence and Brand Reputation

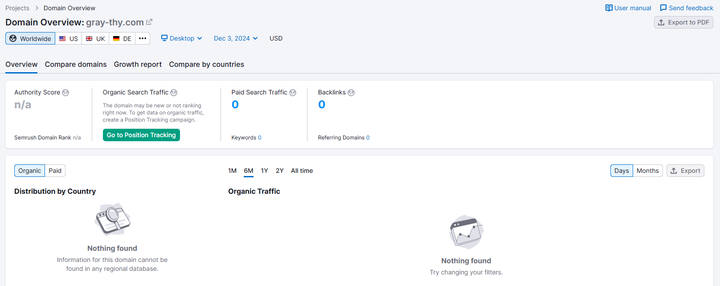

According to Semrush, Gray-Thy’s website receives fewer than 50 visits per month, indicating negligible market presence. Additionally, there are virtually no user reviews or related reports online, which is unusual for a legitimate financial platform. Additionally, Gray-Thy’s website design looks a lot like known scam sites like ANCETD and COMETA. This raises more doubts about its trustworthiness.

2. Trading Products and Offerings

2.1 Variety of Trading Products

Gray-Thy claims to provide the following major trading instruments:

- Forex Trading: Covers a wide range of major currency pairs, such as EUR/USD, GBP/USD, and USD/CAD.

- Precious Metals Trading: Includes gold (XAUUSD) and silver (XAGUSD) spot trading.

- Energy Trading: Offers trading opportunities in U.S. crude oil (UsOIL).

The range of products seems diverse. However, the platform does not share important trading details like spreads, leverage, and fees. This lack of transparency makes it difficult for investors to evaluate trading costs and potential profitability.

2.2 Missing Information on Trading Conditions

The platform claims to provide flexible leverage and a professional trading environment, but key details remain unclear:

- Leverage Ratios: Specific leverage ranges are not disclosed, leaving investors uncertain about risk levels.

- Fees and Spreads: Omission of critical information on trading fees prevents users from comparing its competitiveness.

3. Trading Platforms and Technical Support: Promises vs. Reality

3.1 Claimed Features

Gray-Thy advertises itself as offering a globally leading trading platform, compatible with PC, iOS, and Android. It shows features like strong chart analysis tools and many technical indicators to attract skilled investors.

3.2 Actual Issues and Technical Flaws

Despite these claims, investigations reveal significant technical shortcomings and security risks:

- PC Version: The download link redirects users to an account login page without providing a standalone installation package.

- iOS Version: The App Store link directs users to “NativeFX6,” a non-official app that poses potential security risks.

- Android Version: The Google Play link points to “QINPINSQY,” an app with overwhelmingly negative reviews indicating scam activity.

These technical issues not only compromise user experience but may also expose users to security breaches.

4. Regulatory Information: Misrepresentation and Risks

4.1 Regulatory Claims

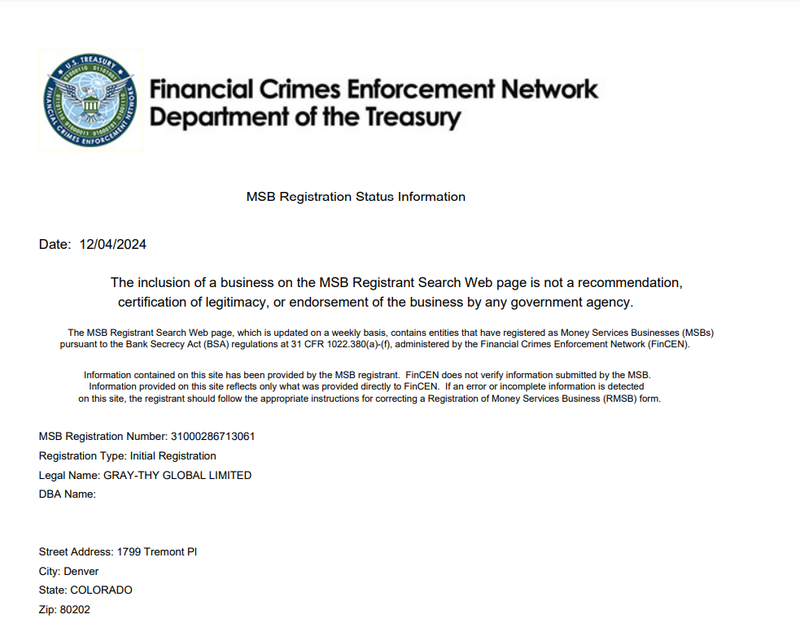

Gray-Thy’s website says it is regulated by the U.S. MSB (Money Service Business). It shows registration details on the Financial Crimes Enforcement Network (FinCEN). At first glance, this might appear to provide some legitimacy.

4.2 Findings from Investigations

- Limitations of MSB: MSB is not a financial regulator. Its main job is to prevent money laundering. It does not oversee forex trading.

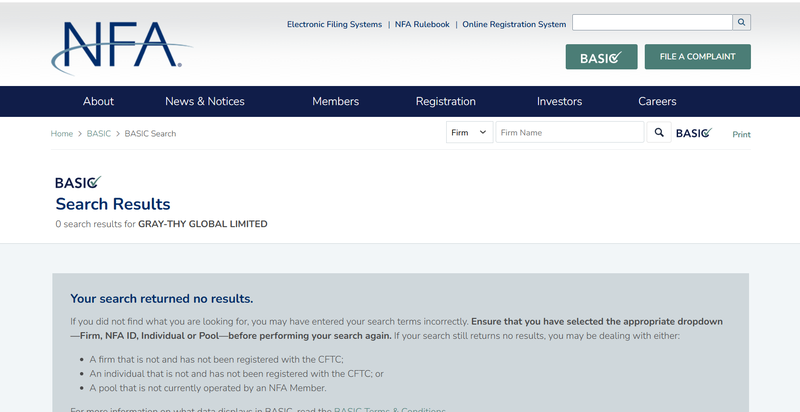

- No NFA Registration: Searches in the National Futures Association (NFA) database show no registration for Gray-Thy. This means there is no proper financial oversight.

- No Global Certifications: Gray-Thy lacks certification from any international financial authority, making its claims of regulation meaningless.

4.3 Implications for Investors

Without regulatory protection, users’ funds are exposed to significant risks. In case of disputes or platform issues, investors may find it impossible to recover their money.

5. Customer Support and Transparency: Trust Deficit

5.1 Limited Customer Support

Gray-Thy offers customer service exclusively through email ([email protected]) and claims to operate 24/7. However, the absence of phone support or live chat severely limits its ability to address urgent user concerns.

5.2 Absence on Social Media

Unusually, Gray-Thy does not have official accounts on any social media platforms. This lack of transparency further undermines investor confidence in the platform.

6. Similarities with Known Scam Platforms

6.1 Website Design and Scam Indicators

Gray-Thy’s website design is strikingly similar to those of known scam platforms like ANCETD and COMETA. Such platforms are often mass-produced using low-cost templates to lure unsuspecting investors into fraudulent schemes.

6.2 Risks Associated with Applications

The platform’s linked third-party apps are not officially endorsed and may contain malicious code or outright scams. Investors should avoid downloading or using these applications.

7. Risk Summary and Investor Recommendations

7.1 Key Risks

- No Regulatory Protection: The platform operates without oversight from recognized financial authorities.

- Lack of Transparency: Critical details like leverage, spreads, and fees are undisclosed.

- Technical and Security Concerns: Linked applications are potentially fraudulent and unsafe for use.

- Low Brand Credibility: The platform’s minimal market presence and similarities to scam sites raise red flags.

7.2 Recommendations

Overall, Gray-Thy is a high-risk platform unsuitable for any investor, particularly beginners or those prioritizing fund safety. Choose platforms with a solid reputation and proper regulatory certifications.

8. FAQs

1. Is Gray-Thy regulated?

No. The platform says it follows MSB rules, but MSB does not regulate forex trading. It is not registered with the NFA or any other real authority.

2. Are trading conditions transparent?

No. The platform does not share important details like leverage, spreads, or fees. This makes it hard to assess trading costs.

3. Are Gray-Thy’s applications safe to use?

No. The linked applications, such as NativeFX6 and QINPINSQY, lack official status and show signs of potential fraud.

4. Is Gray-Thy suitable for beginners?

No. Gray-Thy has big risks for beginner traders. This is because it lacks transparency, regulatory protection, and technical support.

5. How can I ensure my funds are safe?

Gray-Thy does not ensure fund safety. Use platforms with proper regulation and a strong track record.

6. Is Gray-Thy trustworthy?

Based on the evidence, Gray-Thy appears to be a high-risk platform with significant credibility issues. It is not recommended for any form of investment.