Vestrado, established in 2020, is a forex broker offering high-leverage trading. However, its lack of transparent regulatory oversight raises concerns about investor fund security.

Company Overview

Vestrado Ltd was founded in 2020 in Saint Vincent and the Grenadines. As a relatively new forex broker, it provides financial trading services to investors worldwide. The company supports trading in various financial instruments, including forex, metals, energy, and indices, through its online trading platform. Vestrado aims to attract both novice and experienced investors with a range of products and competitive conditions.

Vestrado offers four types of trading accounts, each with a minimum deposit requirement of only $10, making it appealing to emerging markets, particularly for those entering the financial market for the first time. The company’s primary trading platform is MetaTrader 4, known for its user-friendliness and versatility within the industry. Notably, Vestrado offers a high leverage of up to 1:2000, which is highly attractive to investors looking to expand their trading size. However, this high leverage also carries significant risks, which investors need to be cautious of.

Registration Information

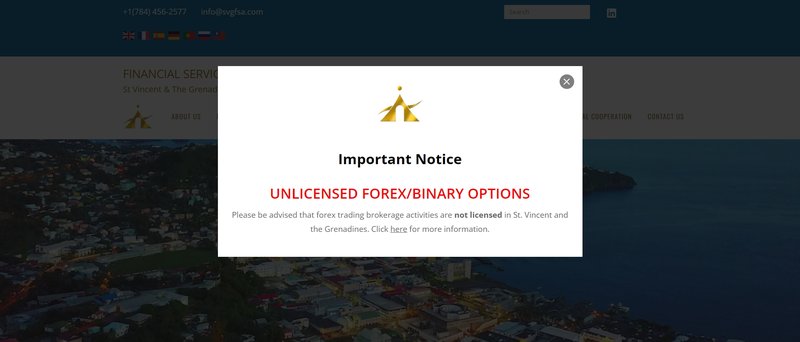

Vestrado is registered with the Financial Services Authority (SVG FSA) of Saint Vincent and the Grenadines, under registration number 25911. While the company is registered with SVG FSA, it’s important to note that SVG FSA does not regulate forex trading activities. The authority is only responsible for company registration but does not supervise or control their forex market activities.

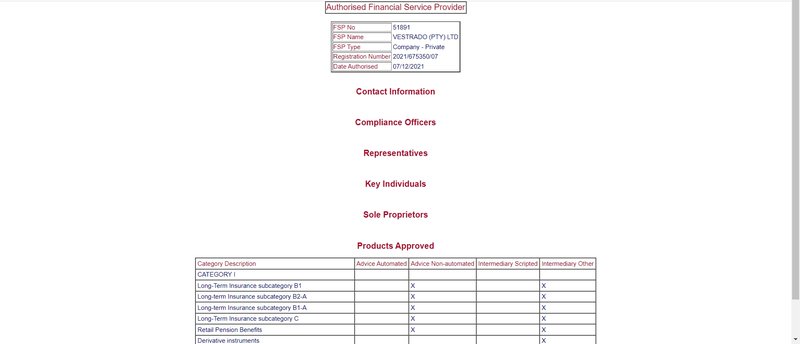

Additionally, Vestrado claims to be registered with the Financial Sector Conduct Authority (FSCA) in South Africa, under registration number 51891. However, further investigation shows that this registration number does not cover the regulation of forex trading. Therefore, while Vestrado is registered with both SVG and FSCA, it is not strictly regulated for its financial trading activities, leaving investors with limited protection, which increases potential risks.

Misleading Regulatory Information

Although Vestrado claims to be registered with both FSCA in South Africa and SVG FSA, these regulatory bodies do not oversee its forex trading activities. For forex investors, choosing a broker under the supervision of a reliable regulatory authority is crucial. Legitimate regulation ensures that companies operate in compliance with legal standards and provides stronger protection for client funds.

Unregulated companies may have weaknesses in fund segregation, customer protection, and trade transparency. If a platform faces financial difficulties or mismanagement, investors may not be able to seek compensation or protection through legal means. For forex investors, such lack of transparency and regulatory oversight is a key risk to avoid when selecting a trading platform.

In the forex market, trusted regulatory bodies typically include the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), which provide comprehensive fund protection mechanisms for clients. Since Vestrado does not operate under similar stringent regulations, the platform’s legitimacy and the security of client funds are called into question.

Leverage Risks

Vestrado offers leverage up to 1:2000, which is extremely high in the forex market. High leverage enables traders to increase their market exposure by using smaller capital to control larger trading positions, amplifying potential gains. However, the higher the leverage, the greater the risks for investors.

High leverage magnifies not only profits but also losses. In highly volatile market conditions, traders using leverage may face rapid losses due to insufficient funds, which could lead to a margin call or even account liquidation. This risk is particularly significant for inexperienced traders, who may not fully understand market fluctuations and end up taking on more risk than they can manage.

For example, with a 1% market movement, an investor using 1:2000 leverage could see significant changes in their account balance. If the market moves against the trader, the losses will be significantly magnified. In this scenario, the investor’s account balance could be depleted in minutes. While high leverage offers opportunities for seasoned traders, it poses substantial risks for most investors, especially beginners.

Internationally, leading regulatory bodies typically impose leverage limits on forex trading. For instance, the European Union caps leverage at 1:30 to protect investors from excessive risks. While Vestrado’s 1:2000 leverage may seem appealing, it carries considerable risks.

Conclusion

As a relatively new forex broker, Vestrado provides a variety of trading instruments and offers competitive leverage. However, its lack of transparent regulation and the risks associated with high leverage should raise caution among investors. Unregulated platforms often have issues with fund protection and transparency, and the high leverage further increases the risks for traders.

When selecting a forex broker, investors should prioritize those regulated by established financial authorities to ensure the safety of their funds and the legitimacy of their trades. For a newer platform like Vestrado, investors are advised to fully understand the potential risks before proceeding with caution.

FAQ

- Is Vestrado regulated?

Vestrado is registered with the SVG FSA and FSCA, but these authorities do not strictly regulate its forex trading activities. - What trading instruments does Vestrado offer?

Vestrado offers trading services for forex, metals, energy, indices, and other financial instruments. - What is the maximum leverage Vestrado provides?

Vestrado offers leverage up to 1:2000, which is considered very high. - What are the risks of high-leverage trading?

High leverage amplifies both potential profits and losses, increasing the risk of significant losses, especially in volatile markets. - Is Vestrado suitable for beginner investors?

Due to the high leverage and lack of strict regulation, Vestrado presents higher risks for beginner investors, who should proceed with caution. - How safe are funds with Vestrado?

Given the lack of strict regulation, the safety of funds with Vestrado remains uncertain, and investors should exercise caution.