This article provides an in-depth analysis of gnexus4’s corporate background, domain registration time, the authenticity of its registration information, lack of regulation, unclear trading information, outdated educational resources, website traffic, and false claims to help investors fully assess the potential risks of this platform.

1. Overview of Corporate Background

1.1 gnexus4’s Establishment and Business Scope

According to its official website, gnexus4 is a forex and CFD (Contracts for Difference) broker that offers trading services for forex, stocks, indices, precious metals, futures, and commodities. The company claims to be registered in the United Kingdom, with its official website being gnexus4.com. gnexus4 also states that it offers both virtual and real accounts. Virtual accounts allow users to view real market prices, which can be useful for beginner investors to familiarize themselves with the platform without financial risk.

1.2 gnexus4’s Account Types

While gnexus4 claims to offer various account types with different functionalities, there are no detailed descriptions of these accounts on its website. Key information such as minimum deposit requirements, deposit methods, withdrawal processing times, and fees are missing. The lack of such crucial details makes it difficult for investors to fully understand the platform’s actual trading conditions, raising concerns about its transparency.

2. Extremely Short Domain Registration Time

2.1 Website Registration Time

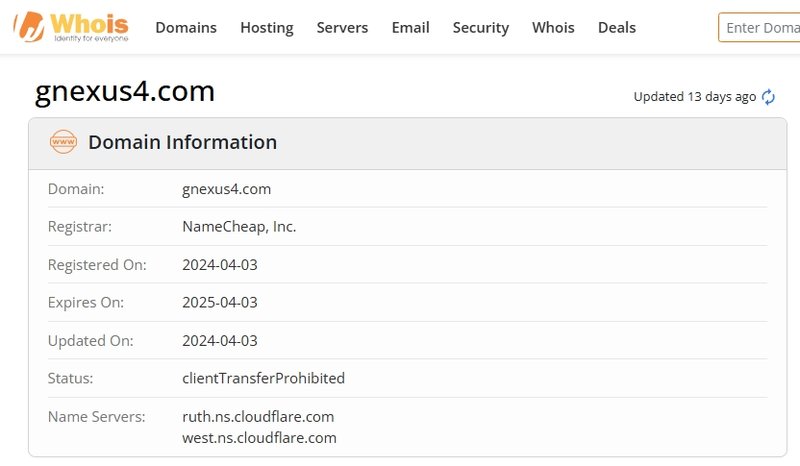

A Whois search shows that gnexus4 registered its domain on April 3, 2024, just 6 months before this article was written. This extremely short operation time raises questions about the platform’s stability and credibility compared to long-established brokers with a proven track record.

2.2 Potential Issues with Newly Registered Domains

Newly registered websites often face operational instability, especially in the forex and CFD markets where fraudulent platforms frequently disappear after a short time, taking clients’ funds with them. A short domain registration time suggests the platform hasn’t undergone market testing, making it difficult for investors to evaluate its long-term stability and service quality. Additionally, new platforms may lack the experience to handle unexpected events such as website crashes or trading delays, which can negatively impact the user experience and result in financial losses.

3. False Registration Information

3.1 gnexus4’s Suspicious Registered Address

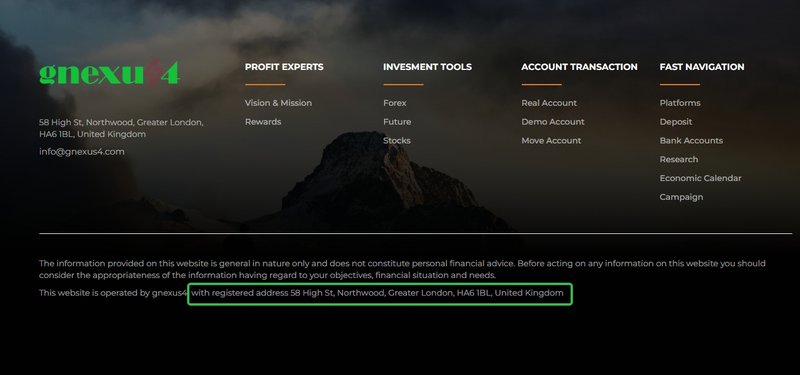

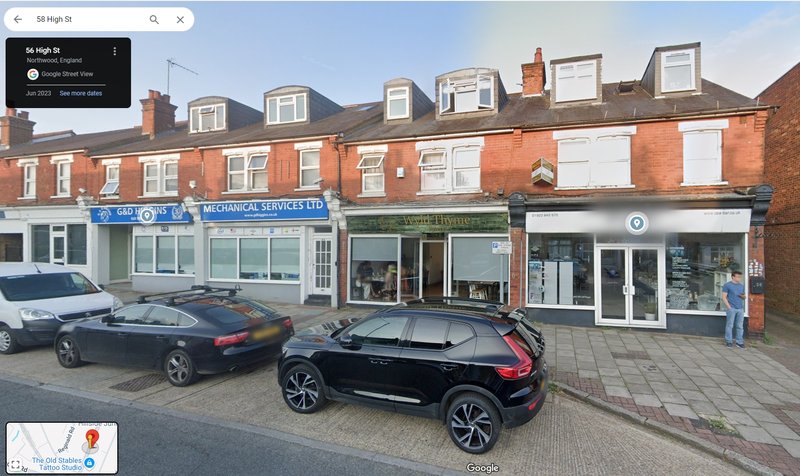

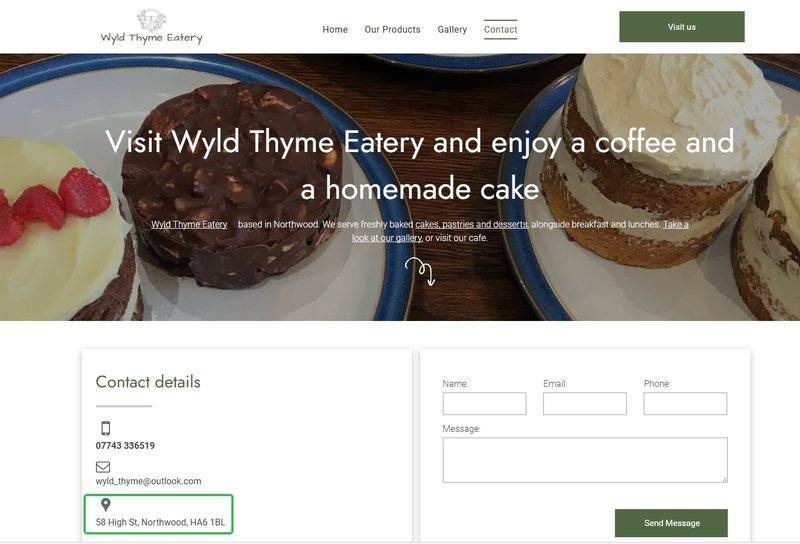

gnexus4’s website lists its registered address as 58 High St, Northwood, Greater London, HA6 1BL, United Kingdom. However, upon further investigation, it appears that this address may be false. A search of the UK Companies House database did not return any records for gnexus4. When a company claims UK registration, it should appear in the Companies House records. However, gnexus4 has not provided any proof of its registration.

3.2 Discrepancies in Address Verification

A Google Maps search of the given address shows that it is located near a restaurant, with nearby businesses including a mechanical services company and a spa bar. This raises doubts about whether gnexus4 is legitimately operating from this address or if it is simply using the location as a front. The false address raises further concerns about the legitimacy of gnexus4 and the credibility of its operations.

4. Major Risks of Operating Without Regulation

4.1 Lack of Regulation as a Warning Sign

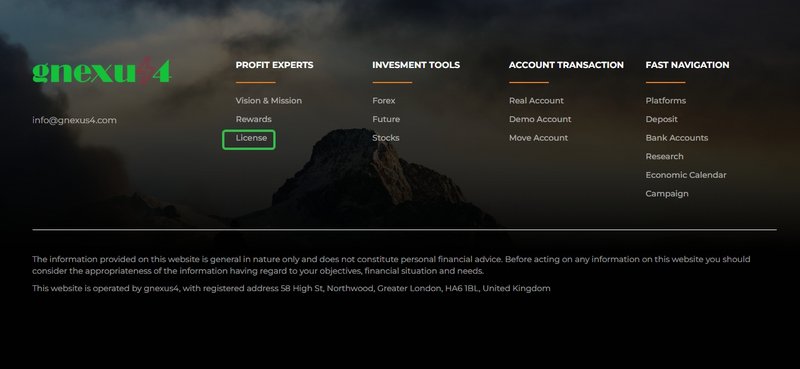

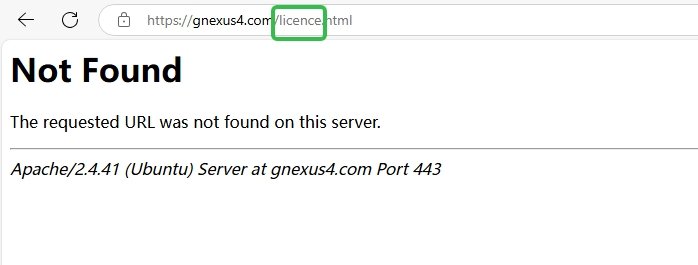

gnexus4 does not provide any clear regulatory information on its website. Although there is a “LICENSE” button under the “Privacy Policy” section, clicking on it does not lead to any valid license details. Financial authorities must issue regulatory licenses to protect investor rights, and any legitimate forex or CFD broker must obtain regulation from the appropriate authorities. The absence of any valid regulatory information from gnexus4 is a major red flag.

4.2 Risks of Unregulated Platforms

Financial authorities do not oversee unregulated platforms, leaving investors’ funds inadequately protected. If gnexus4 encounters problems, such as withdrawal issues, fund mismanagement, or even fraudulent behavior, investors would struggle to take legal action. Additionally, unregulated companies may engage in unfair trading practices, such as manipulating spreads or increasing slippage, further increasing the risks for investors.

5. Lack of Transparency in Trading Information

5.1 Missing Key Trading Information

On gnexus4’s website, investors cannot find crucial trading information such as spreads, leverage, fees, and minimum deposits. The absence of these details makes it difficult for investors to calculate their trading costs and increases uncertainty in transactions. For example, spreads and leverage significantly impact both the costs and risks of each trade, yet gnexus4 fails to disclose these important data, making it hard for investors to make informed decisions.

5.2 Impact of Unclear Trading Information on Investment Decisions

Transparent trading conditions are a key indicator of a safe and reliable forex and CFD platform. Without clarity on costs and trading conditions, investors cannot accurately assess the potential risks and returns. Moreover, gnexus4 does not explain how it manages traders’ funds, and the lack of transparency regarding deposit and withdrawal processes creates further concerns about liquidity and fund security.

6. Outdated Educational Resources

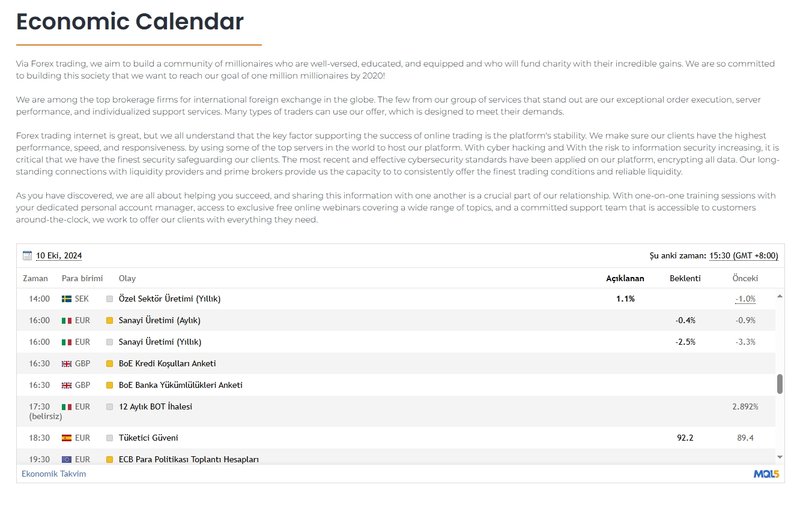

6.1 Outdated Market Analysis

gnexus4 offers educational resources on its website, including an Economic Calendar and a Research section. These sections aim to provide market information and analysis for traders. However, the Research section lists the latest market analysis from 2020, clearly outdated and inconsistent with gnexus4’s 2024 domain registration date.

6.2 Impact of Educational Resources on Investors

Educational resources are essential for beginner traders to understand market basics and develop trading strategies. However, the outdated information provided by gnexus4 is not only unhelpful but also potentially misleading. The lack of up-to-date resources suggests that gnexus4’s content management is inadequate, further exposing the platform’s inexperience and operational flaws.

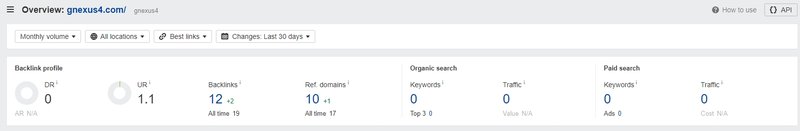

7. Lack of Website Traffic and User Base

7.1 gnexus4’s Website Traffic Analysis

According to ahrefs data, gnexus4’s website has had zero traffic in the past month. This suggests that almost no users have visited the website, raising concerns about the platform’s visibility and whether it has any active users at all. For a broker that claims to offer a wide range of financial products, having no website traffic is a serious issue.

7.2 Implications of Low Traffic

Zero website traffic indicates that gnexus4 likely lacks a genuine user base and market participation. For any forex and CFD broker, a robust and active user base is crucial for building trust and credibility. The absence of user engagement implies that gnexus4 may have significant operational issues or could be an empty shell platform designed to deceive investors.

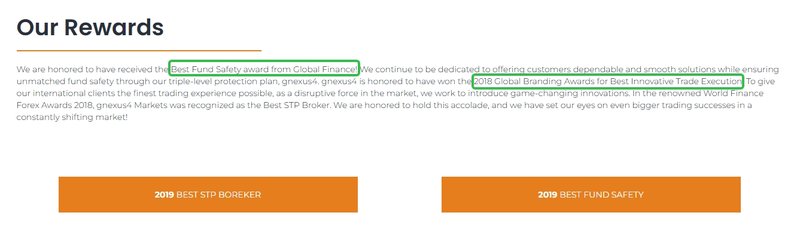

8. False Claims and Award Fabrications

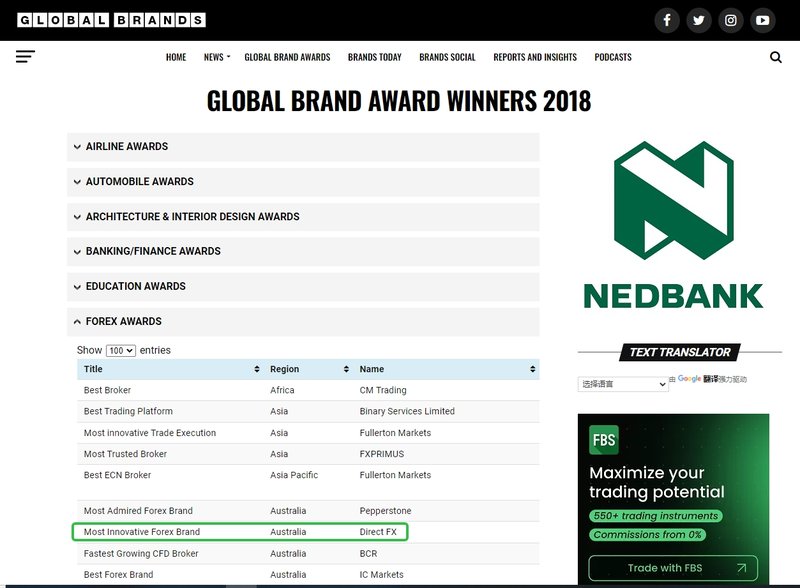

8.1 Questionable Award Claims

On its website, gnexus4 claims to have won several international awards, including the “Best Fund Safety Award” from Global Finance and the “Best Innovative Trade Execution Award” from the 2018 Global Brand Awards. However, further investigation reveals that Global Finance does not offer a “Best Fund Safety Award” and primarily grants awards in the banking sector. Additionally, the 2018 “Best Innovative Trade Execution Award” was given to Direct FX, not gnexus4.

8.2 The Risks of False Claims

By falsely claiming to have received these awards, gnexus4 attempts to enhance its reputation and attract investors. However, these fabricated awards cast serious doubt on the platform’s credibility and suggest that the company may be engaging in fraudulent practices. Such false claims mislead investors into trusting the platform, potentially leading to significant financial losses.

9.

In conclusion, gnexus4 is a newly established forex and CFD broker with numerous red flags. The short domain registration time, suspicious registration address, lack of regulation, unclear trading conditions, outdated educational resources, and false award claims all point to significant risks for investors. Anyone considering using gnexus4 should exercise extreme caution and seek out more established, regulated platforms to ensure the safety of their funds.

FAQ

1. Is gnexus4 regulated?

gnexus4 does not provide any valid regulatory information and may not be regulated by any financial authority.

2. Are gnexus4’s account types and trading conditions transparent?

gnexus4 claims to offer various account types, but it does not disclose specific trading conditions such as minimum deposits, spreads, and fees, which raises concerns about transparency.

3. What is gnexus4’s website traffic like?

According to recent data, gnexus4’s website has had zero traffic in the past month, suggesting a lack of user engagement or operational issues.

4. Can gnexus4 be trusted?

gnexus4 raises multiple concerns, including false registration information, lack of regulation, unclear trading conditions, and false award claims. Investors should be cautious.

5. How reliable are gnexus4’s educational resources?

gnexus4’s educational resources are outdated, with the latest market analysis dating back to 2020, which limits their usefulness to investors.

6. Is gnexus4 suitable for beginner investors?

Due to the high risks, lack of transparency, and false claims, gnexus4 is not recommended for beginner investors.