This article provides an in-depth analysis of Miracle FX’s background, account structures, regulatory status, and potential risks, helping investors evaluate the platform’s safety and make informed investment decisions.

1. Background of Miracle FX

Miracle FX is an online platform primarily focused on forex and contract-for-difference (CFD) trading, offering diverse assets such as forex, precious metals, oil, indices, and cryptocurrencies. According to the website miraclefx.biz, Miracle FX claims to have been established in 2019 with its headquarters in Dubai, positioning itself as a top broker worldwide. The platform claims to hold multiple regulatory licenses. However, the website does not provide specific company registration information or clear details regarding these regulatory bodies.

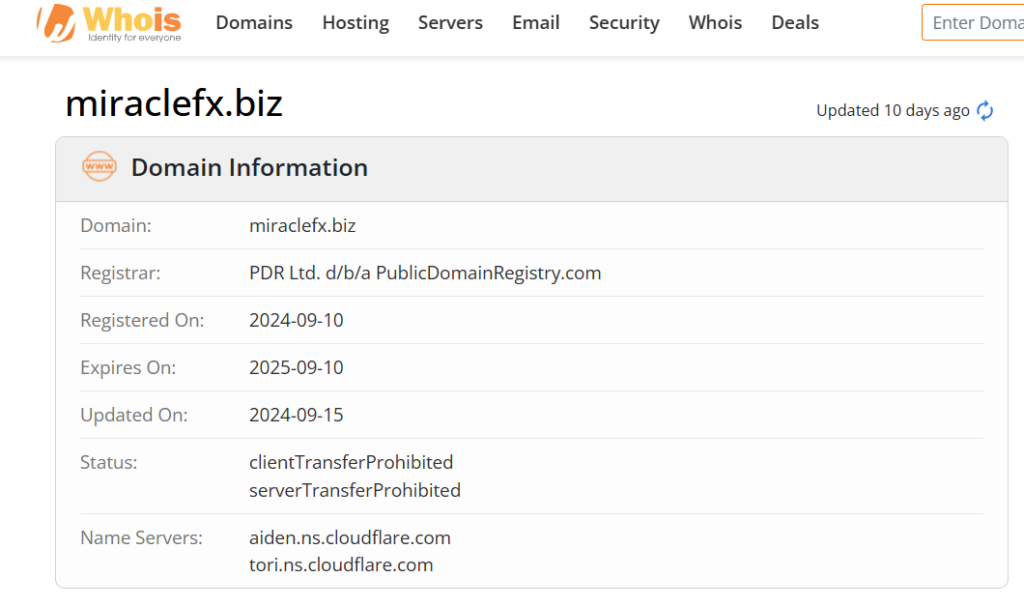

2. Domain Registration Information: Establishment Date and Platform Stability

A domain query shows that Miracle FX’s official website, miraclefx.biz, was registered in September 2024, indicating a recent launch. Investors often consider the operational history of a trading platform to evaluate its stability. A short operating period can cast doubt on the platform’s reputation and stability, raising concerns about its legitimacy and safety.

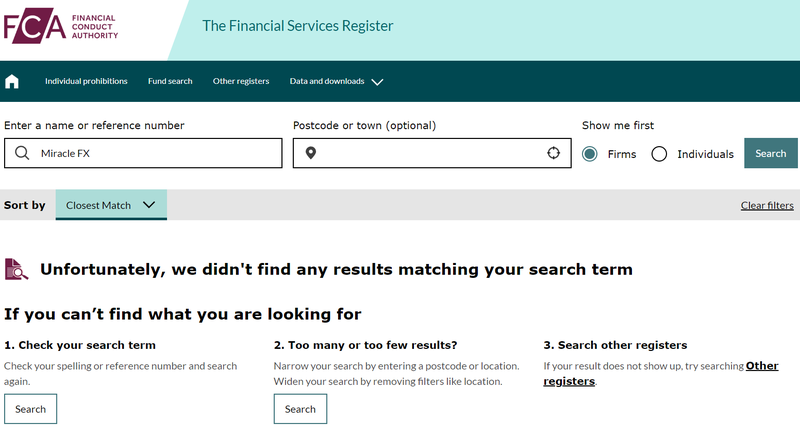

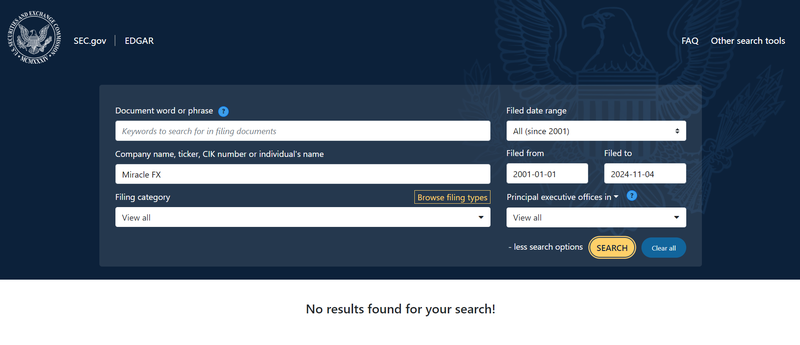

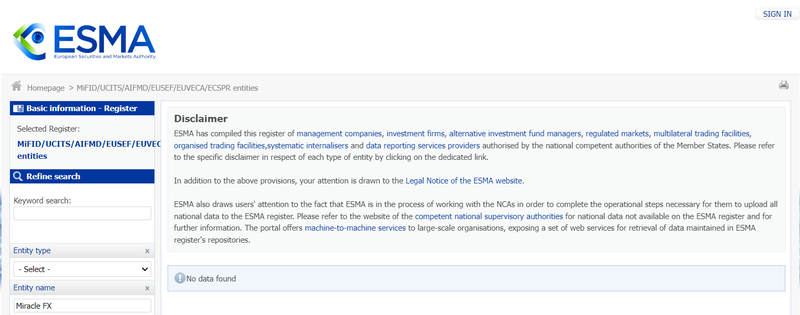

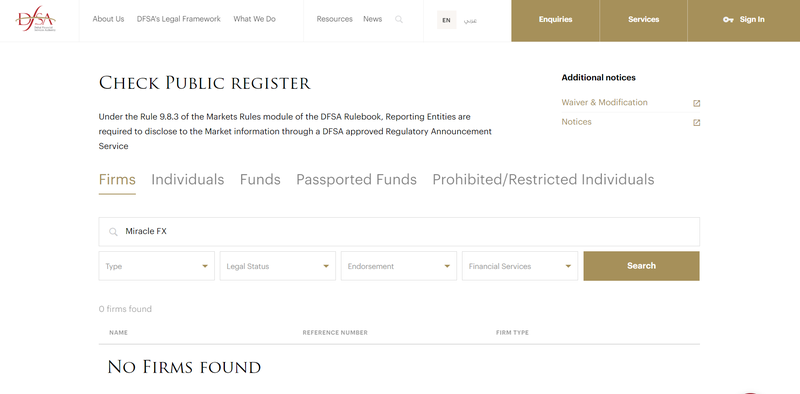

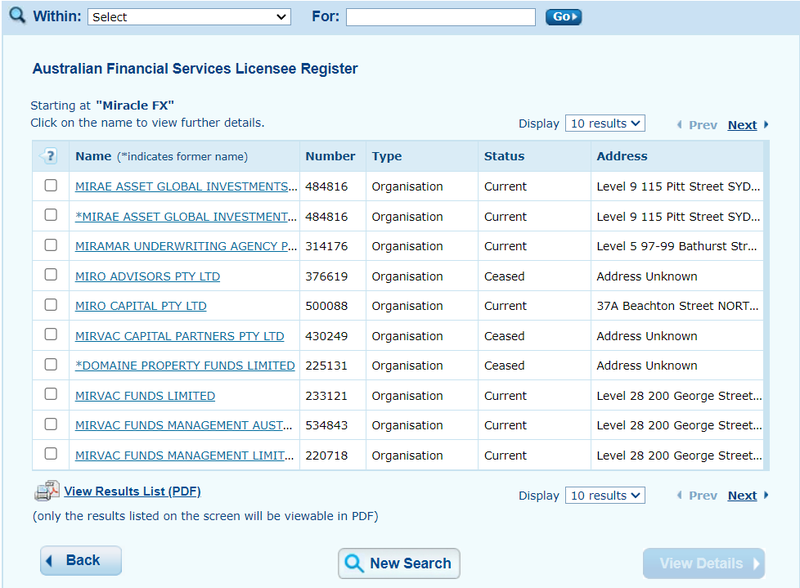

3. Entity Registration and Regulatory Status

Miracle FX claims its headquarters in Dubai and states that it holds multiple international regulatory licenses. However, research shows no records of Miracle FX being registered with major financial regulators, including the UK’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), the European Securities and Markets Authority (ESMA), or the Dubai Financial Services Authority (DFSA). This lack of regulatory information brings the platform’s compliance into question for potential investors.

4. Importance of Entity Registration and Regulation

4.1 Importance of Entity Registration for Investors

Registration information confirms a company’s legitimacy and physical presence, helping investors understand its actual operations. Platforms lacking real entity registration may jeopardize investor funds. Some fraudulent platforms fabricate company backgrounds or use fake addresses to deceive investors, often disappearing after collecting funds. Therefore, a clear registration record is crucial for assessing the platform’s legitimacy.

4.2 Protection of Investor Rights through Regulation

A regulatory license is more than a certificate—it’s essential for protecting investor rights. Regulated financial platforms must comply with strict standards for fund segregation, transparency, and compliance, ensuring that investor funds are not misused. Without regulatory records for Miracle FX with key authorities, investors may face difficulty resolving disputes should financial issues arise. Investors are thus advised to prioritize platforms with verified regulatory credentials to ensure their protection.

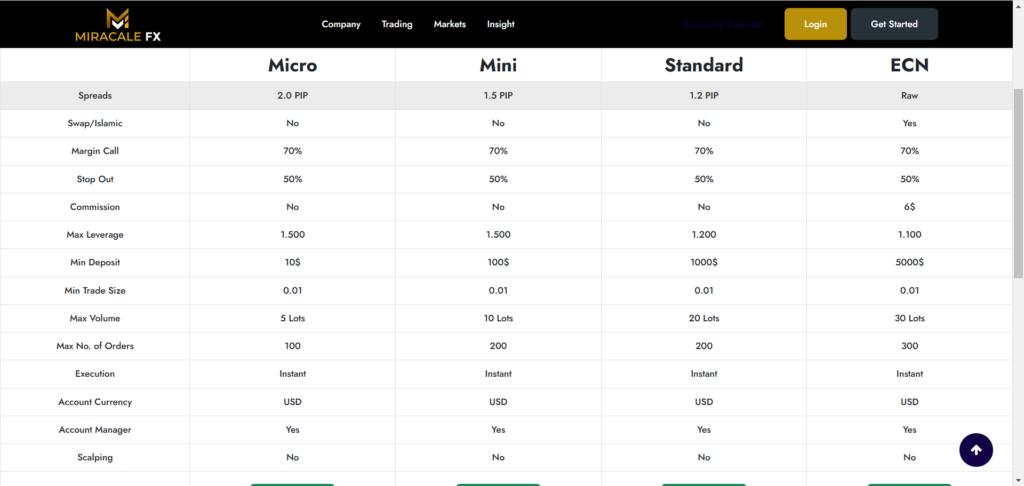

5. Analysis of Miracle FX Account Types and Financial Information

Miracle FX offers four account types—Micro, Mini, Standard, and ECN—each with distinct requirements for minimum deposit, spread, leverage, and other conditions. However, certain financial information and conditions raise questions regarding transparency and risks. Below is an analysis of each account type, uncovering potential issues.

5.1 Micro Account

- Minimum Deposit: $10

- Spread: 2.0 pips

- Maximum Leverage: 1:500

- Margin Call Level: 70%

- Stop-Out Level: 50%

- Other Conditions: No swap-free/Islamic accounts, no commission, minimum trade size of 0.01 lots, maximum order size of 5 lots, maximum total order volume of 100 lots, scalping not allowed, instant execution.

Analysis of Concerns:

- High Leverage with Low Deposit Requirement: The Micro account offers high leverage of 1:500 with a minimum deposit of just $10, allowing investors to enter the market at low cost. While this increases accessibility, high leverage also amplifies market volatility risks, especially for novice investors who may lack risk awareness and face substantial losses.

- No Islamic Account Option: The absence of a swap-free/Islamic account may be restrictive for investors with specific religious requirements, potentially limiting Miracle FX’s appeal in competitive markets.

- Limited Trade Size: The maximum trade size of 5 lots per trade may restrict more experienced or higher-capital investors, limiting flexibility in trading volumes.

5.2 Mini Account

- Minimum Deposit: $100

- Spread: 1.5 pips

- Maximum Leverage: 1:500

- Other Conditions: Same as Micro account, with similar margin call and stop-out levels, currency, order sizes, and scalping restrictions.

Analysis of Concerns:

- Lower Spreads with High Leverage: The Mini account offers a slightly lower spread of 1.5 pips but maintains 1:500 leverage. For low-capital accounts, this high leverage could lead to rapid losses during market fluctuations, especially if investors lack adequate risk management.

- Questionable Profitability of Low Spreads: Typically, low spreads paired with high leverage may reduce platform profit margins, but high leverage can also encourage frequent trading, ultimately increasing the platform’s income. This combination may entice users to trade frequently, posing potential risks to investor funds.

5.3 Standard Account

- Minimum Deposit: $1000

- Spread: 1.2 pips

- Maximum Leverage: 1:200

- Other Conditions: Similar to Micro account, with same margin call, stop-out, currency, and scalping limitations.

Analysis of Concerns:

- Higher Deposit Requirement: With a minimum deposit of $1000, the Standard account requires a larger upfront investment compared to the Micro and Mini accounts, which may deter smaller investors. However, experienced traders might find the 1.2 pips spread and 1:200 leverage more appealing.

- Reduced Leverage: Compared to the 1:500 leverage offered by Micro and Mini accounts, the 1:200 leverage here limits capital utilization but also reduces trading risk. Whether this restriction aligns with the platform’s claim of “diverse, flexible trading options” remains unclear.

- Scalping Not Allowed: This restriction might limit short-term traders, particularly those seeking quick gains, making trading more restrictive.

5.4 ECN Account

- Minimum Deposit: $5000

- Spread: Raw spreads

- Commission: $6

- Maximum Leverage: 1:100

- Other Conditions: Similar to Micro account, with same margin call and stop-out, but the only account type that offers a swap-free/Islamic option.

Analysis of Concerns:

- High Deposit Requirement: With a minimum deposit of $5000, the ECN account targets institutional investors or traders with significant capital. While raw spreads and $6 commission structure appeal to experienced traders, the low 1:100 leverage requires strong risk tolerance.

- Incompatibility of High Deposit with Low Leverage: Lower leverage reduces risk but also limits potential returns, creating a mismatch with high-frequency trading needs typically associated with ECN accounts.

- Limited Islamic Account Access: The ECN account is the only one offering a swap-free/Islamic account, which may appeal to certain investors. However, the high capital requirement restricts accessibility for smaller investors with religious considerations.

Summary of Account Types and Potential Risks

- Complex Account Conditions: Each account type has significantly different leverage, spread, and deposit conditions, offering variety but also creating inconsistency. For example, the Micro and Mini accounts offer 1:500 leverage but do not allow scalping; the ECN account has a high deposit requirement but only 1:100 leverage. This complexity may confuse novice investors, making it difficult for them to select an account that suits their needs.

- High Leverage without Risk Management: Offering up to 1:500 leverage across multiple accounts increases risk, particularly for beginners with limited capital and risk management skills. High leverage coupled with a low deposit threshold may attract short-term speculators, but without robust risk management, this could lead to high losses.

- Opaque Account Terms: Certain key details, such as whether spreads may adjust with market volatility, or the execution conditions of the margin call and stop-out levels, are unclear. Vague terms may raise doubts for investors during trading.

- Limited Appeal of High-Deposit Accounts: With a high deposit requirement, the ECN account is less appealing to average investors. The 1:100 leverage and $6 commission may suit high-net-worth or professional traders but restricts other investors.

In conclusion, while Miracle FX offers diverse account options, there remain questions about its financial information transparency and risk exposure.

6. Analysis of Margin Proportions and Compliance

Miracle FX’s margin call level is set at 70% and stop-out at 50%. These figures’ adherence to industry standards and investors’ risk control needs remains uncertain. Generally, margin levels should reflect market volatility risk. Platforms with high leverage require stricter margin settings to prevent rapid losses. With maximum leverage reaching 1:500, Miracle FX’s margin setup may suit experienced traders but may be ill-suited for beginners or those with limited risk tolerance.

7. Customer Support and Social Media Presence

Although Miracle FX’s website displays social media icons like Facebook, Instagram, and Twitter, the platform has no verified presence on these networks. Currently, users can only contact customer support via phone or email listed on the website. For a platform claiming global operations, lacking an official social media presence suggests transparency issues, which may affect credibility.

8. Potential Investment Risks and Recommendations

In summary, while Miracle FX provides various trading options, questions arise concerning its regulatory transparency, margin setup, and overall legitimacy. Notably, gaps in registration information, account structure, and social media presence may raise investor concerns. It’s recommended that investors exercise caution, opting for platforms with verified regulatory credentials and established operating histories to ensure fund security.

FAQ

1. What is Miracle FX?

Miracle FX is an online platform offering forex, CFD, and other asset trading, established in September 2024, claiming a diverse range of investment services.

2. What regulatory agencies oversee Miracle FX?

Research shows no registration or regulation for Miracle FX with key authorities, including the FCA, SEC, ESMA, or DFSA, raising concerns about its compliance.

3. What account types does Miracle FX offer?

The platform provides four types of accounts: Micro, Mini, Standard, and ECN, each with different deposit, leverage, and spread requirements.

4. Is Miracle FX’s margin proportion compliant?

The platform’s margin call level is 70% and stop-out level is 50%, which raises questions, especially given the high leverage and increased risk for investors.

5. What customer support options does Miracle FX offer?

Currently, the platform only offers phone and email support, without official social media accounts, which may affect its credibility.

6. How should investors assess Miracle FX’s legitimacy?

Investors are advised to carefully evaluate Miracle FX’s legitimacy and compliance and consider choosing platforms with confirmed regulatory oversight for fund security.