BFA Markets is an emerging CFD broker with questionable regulatory details and company background, urging investors to exercise caution.

1. BFA Markets Company Background

BFA Markets is a newly established online CFD (Contract for Difference) broker, launched in November 2024. The platform claims to offer a range of CFD trading services for assets such as forex, precious metals, commodities, and indices. According to its website, BFA Markets does not provide services to jurisdictions where such operations would violate local laws. While this suggests some attention to compliance, the information provided remains vague.

1.1 Company Information

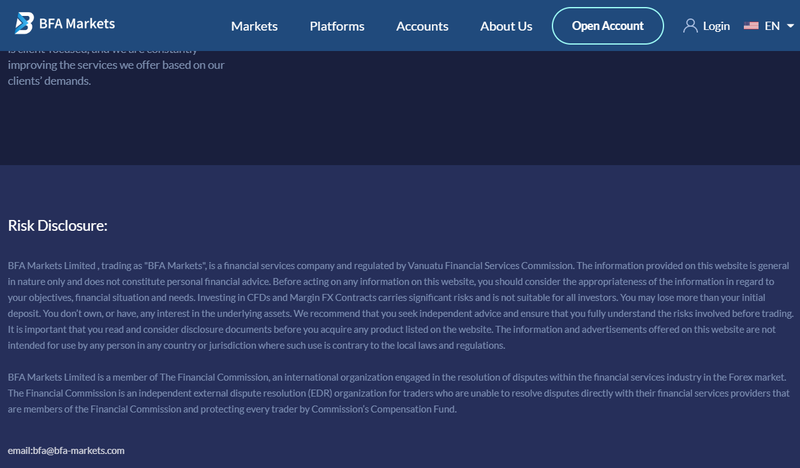

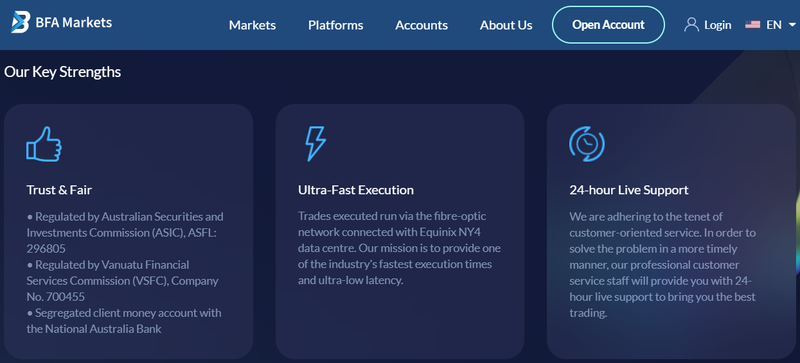

BFA Markets’ operating entity is listed as BFA Markets Limited, which it claims is regulated by the Vanuatu Financial Services Commission (VFSC) with license number 700455, and it also claims membership with The Financial Commission. Additionally, the platform claims regulation by the Australian Securities and Investments Commission (ASIC) under license number 296805. However, the company does not provide contact information such as phone numbers, emails, or official accounts on mainstream social media. This lack of transparency has raised doubts among investors about the platform’s credibility.

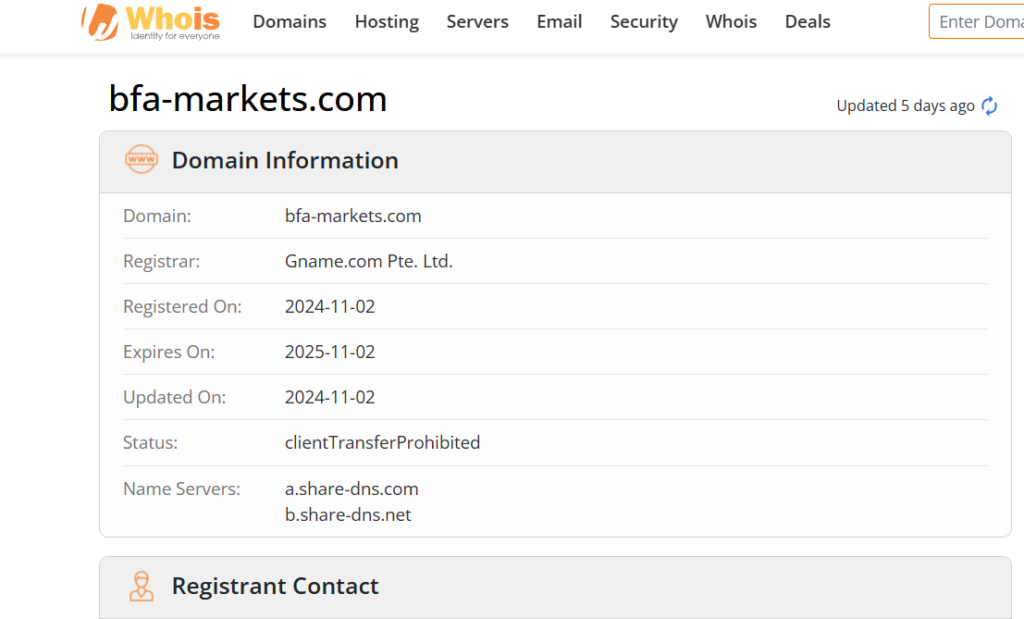

2. Domain Registration Information

According to publicly available domain records, BFA Markets launched its website in November 2024, making it a relatively new domain. In contrast to established financial platforms, this late launch date raises questions about the platform’s operating history or reputation. Most financial institutions launch websites early on to demonstrate transparency and compliance, yet BFA Markets only registered its domain shortly after founding. This has led to industry skepticism regarding its legitimacy and professionalism.

3. Registration Information and Regulatory Status

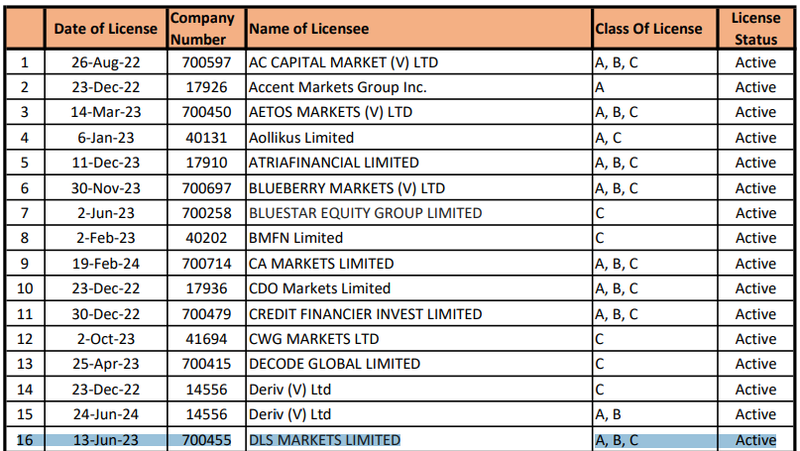

3.1 VFSC Regulation License

According to BFA Markets’ website, the company is regulated by the Vanuatu Financial Services Commission (VFSC) with license number 700455. However, further investigation of the VFSC website shows that license number 700455 actually belongs to DLS Markets Limited, not BFA Markets Limited. This discrepancy raises concerns about the authenticity of its claimed regulatory status.

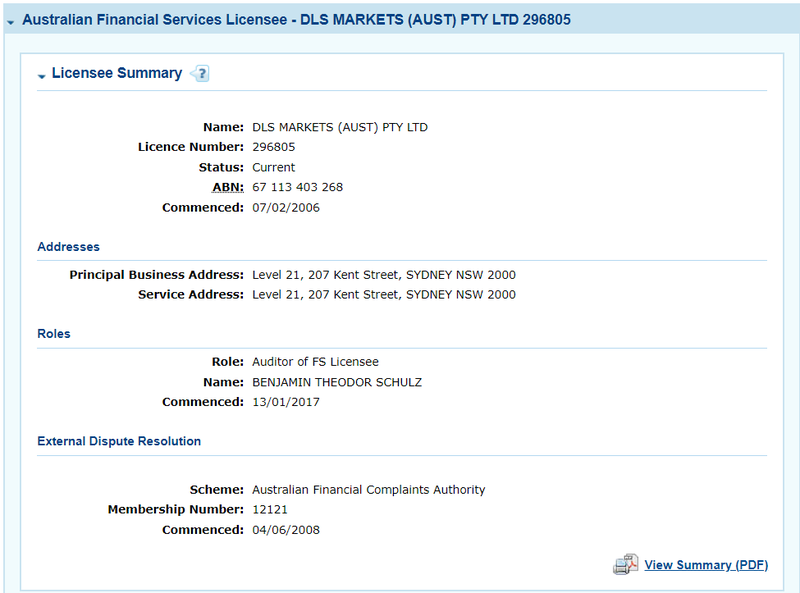

3.2 ASIC Regulation License

BFA Markets also claims on its website that it is regulated by the Australian Securities and Investments Commission (ASIC) under license number 296805. However, verification on the ASIC website shows that license 296805 belongs to DLS Markets (AUST) Pty Ltd, not BFA Markets. This discrepancy indicates that BFA Markets may be engaging in “license cloning,” where a company uses another entity’s license to falsely portray itself as regulated.

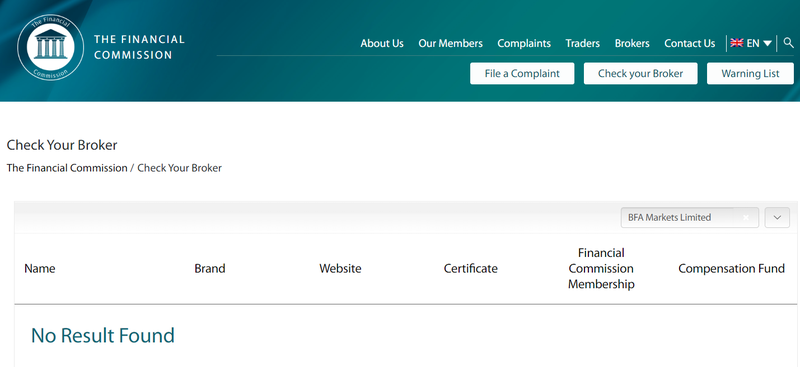

3.3 Financial Commission Membership

BFA Markets claims to be a member of The Financial Commission, yet a check on the commission’s website shows no registered information for this entity. This further deepens investor concerns about the platform’s legitimacy and compliance.

4. Investment Risks on Unregulated Platforms

When choosing a forex or CFD trading platform, investors are typically advised to prioritize those regulated by reputable institutions to ensure the security and compliance of their funds. Regulatory bodies supervise financial companies to ensure industry-standard fund management and provide legal protections for investors.

4.1 Fund Security Risks

BFA Markets’ lack of verifiable regulatory information means that its operations and fund management practices lack oversight from credible regulatory authorities. This not only increases risks for investors but could also make the platform more susceptible to mismanagement or unregulated internal practices.

4.2 Lack of Legal Protection

Without a valid regulatory license, investors may face significant challenges in seeking legal recourse if issues arise with their funds or disputes with the platform. In contrast, licensed financial institutions undergo rigorous review processes during their establishment. BFA Markets’ inconsistent or missing regulatory information leaves investors potentially exposed to higher risks.

5. Website Design Similarities with Other Platforms

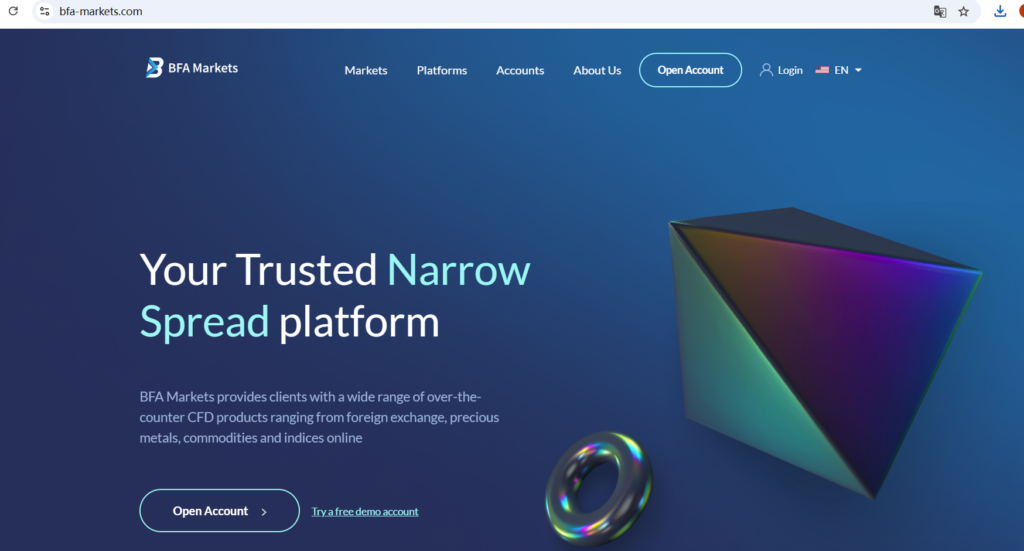

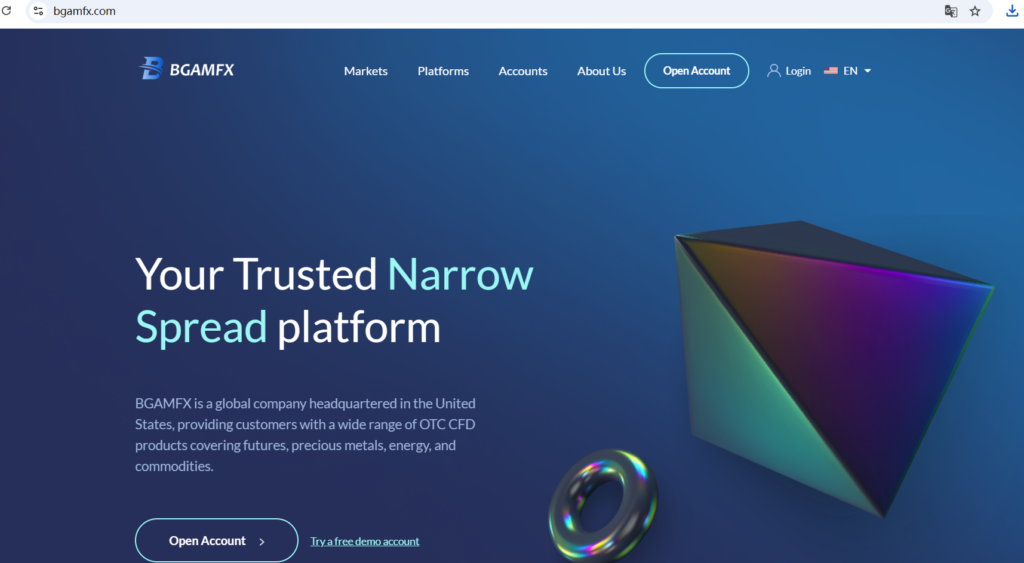

5.1 Similarity to BGAMFX Design

An analysis of BFA Markets’ website design reveals that its page layout, color scheme, and functionality closely resemble those of another forex platform, BGAMFX. Such a high degree of similarity has led to speculation that BFA Markets may be imitating or cloning other platforms. Well-known financial institutions usually invest significantly in creating unique user experiences and brand identity, yet BFA Markets shares a near-identical design with another platform, adding to doubts about its authenticity.

5.2 Risks of “Clone” Websites

A “clone” website uses another platform’s credentials or design to attract investors under false pretenses. Clone sites often operate in a way that conceals their actual operational entity, making it difficult for investors to identify responsible parties if issues arise. BFA Markets’ overlapping regulatory information and website design similarities further increase the likelihood that it may be a clone, and investors are advised to exercise caution.

6. Risks of High-Leverage Trading on BFA Markets

BFA Markets offers investors leverage of up to 1:500. While such high leverage can amplify potential profits, it equally magnifies the risks of losses. Below is a breakdown of the potential risks associated with this high leverage:

6.1 Impact of Leverage Levels on Investors

Both the standard and ECN accounts on BFA Markets allow for leverage of up to 1:500, which enables investors to increase their trading positions with relatively low capital. However, such high leverage is unsuitable for all investors, particularly those with limited experience or low risk tolerance. In volatile markets, high leverage can rapidly increase losses, potentially resulting in substantial or even total loss of capital in a short time.

6.2 Risks of High Leverage Without Regulatory Limits

In regulated markets, many financial authorities impose strict leverage limits to control investor risk. For example, in regions like Europe and Australia, leverage for retail investors is typically limited to between 1:30 and 1:50 to prevent over-leveraging. However, BFA Markets lacks oversight from major regulatory bodies, meaning its high leverage operates without restrictions. Investors using high leverage on an unregulated platform could face unexpected losses, with limited options for risk control.

7. BFA Markets’ Account Types and Risk Assessment

BFA Markets offers two primary account types: the Standard Account and the ECN Account. These accounts differ in terms of trading fees, spreads, and commissions, as outlined below.

7.1 Standard Account Analysis

The Standard Account is BFA Markets’ entry-level option for beginners. Its features include instant execution, access to over 250 tradable assets, and a commission-free model. With a minimum deposit of $200, it appeals to users who want to start trading with a lower capital requirement. However, the high leverage (up to 1:500) in the Standard Account, while offering profit potential, also greatly increases the risk of capital loss. For less experienced traders, using high leverage in this account may lead to significant losses during market volatility. Additionally, BFA Markets’ unclear regulatory status raises concerns about fund security.

7.2 ECN Account Analysis

The ECN Account is designed for traders with higher trading requirements. This account type offers lower spreads, starting from 0.0 pips, making it suitable for high-frequency or high-volume traders seeking reduced trading costs. Unlike the Standard Account, the ECN Account charges a commission of $6 per lot, but the low spread and fast execution make it attractive to experienced investors.

However, the high leverage in the ECN Account also carries significant risk. Even with lower spreads, high leverage can lead to considerable losses over short periods. ECN Account users require strong risk control skills, as any miscalculation could result in severe capital depletion.

8. Key Risks Investors Should Consider

8.1 Lack of Transparency

Due to the absence of adequate contact and regulatory information, investors should pay particular attention to the platform’s transparency. Before investing, it’s crucial to understand if the platform has proper fund management processes and risk control measures.

8.2 Balancing High Returns with High Risks

While high leverage trading is attractive, it also poses a high risk of loss. Investors need to carefully assess their own risk tolerance and avoid pursuing high returns blindly.

9. Conclusion: BFA Markets’ Legitimacy and Safety Analysis

As a new online CFD broker, BFA Markets offers a range of products and high-leverage trading, but several issues related to its company background, regulatory information, and transparency raise concerns. Its inconsistent regulatory details, similarities with other websites, and the inherent risks of high leverage suggest that investors should remain cautious when choosing this platform and avoid investing large amounts without sufficient safeguards.

FAQ

1. Is BFA Markets a regulated broker?

BFA Markets claims to be regulated by VFSC and ASIC, but verification shows the license numbers provided belong to other companies, making the regulatory status unclear.

2. Is the leverage offered by BFA Markets safe?

The 1:500 leverage offered by BFA Markets may be too high for ordinary investors and comes with significant risks. Caution is advised.

3. What types of accounts does BFA Markets offer?

The platform offers Standard and ECN accounts, both supporting CFD trading but differing in spreads and commissions.

4. Is BFA Markets’ regulatory information reliable?

The regulatory information presented by the platform does not match official records, suggesting potential compliance issues.

5. What risks are involved in high-leverage trading?

High leverage can amplify profits but also increases loss potential, especially in volatile markets, and can lead to substantial losses.